A key breakthrough I really grokked during one of my many silent strategy meditation retreats is that strategy is all about alignment – especially once you fully wrap your head around your goal, your resources, and the competitive landscape. Alignment is what gives systems that 1 + 1 = 3 result and misalignment can bring systems to their knees.

A strategy is a set of well-aligned activities with the aim of occupying a valuable position within a competitive landscape.

For example, synchronous rowing has been proven to be 8% faster than non-synchronous rowing. Further, when oars tangle – which can only happen during asynchronous rowing – someone is usually going for a swim. So if your goal is to win a race, then you should row synchronously.

Southwest Airlines

The classic corporate example of great strategic alignment is Southwest Airlines. Growing up in Dallas, Southwest’s headquarters and home-base, I had a front row seat to the company’s incredible growth into its current position as the largest domestic air carrier in the US (by passengers boarded). Over the past 5 decades, Southwest has delivered tens of billions in value to customers, employees, and shareholders. Remarkably, the company has been profitable for 46 consecutive years – which is completely unheard of in the airline industry.

BTW, even if you don’t care for Southwest as a customer, the lessons from this company – especially around alignment – are quintessential for developing your own strategies.

What’s the Goal?

Before digging into the alignment between Southwest’s activities, we need to know their objective. Southwest’s vision is “to become the world’s most loved, most flown, and most profitable airline.” I’m assuming that they have clear internal definitions and KPIs for most loved and most flown.

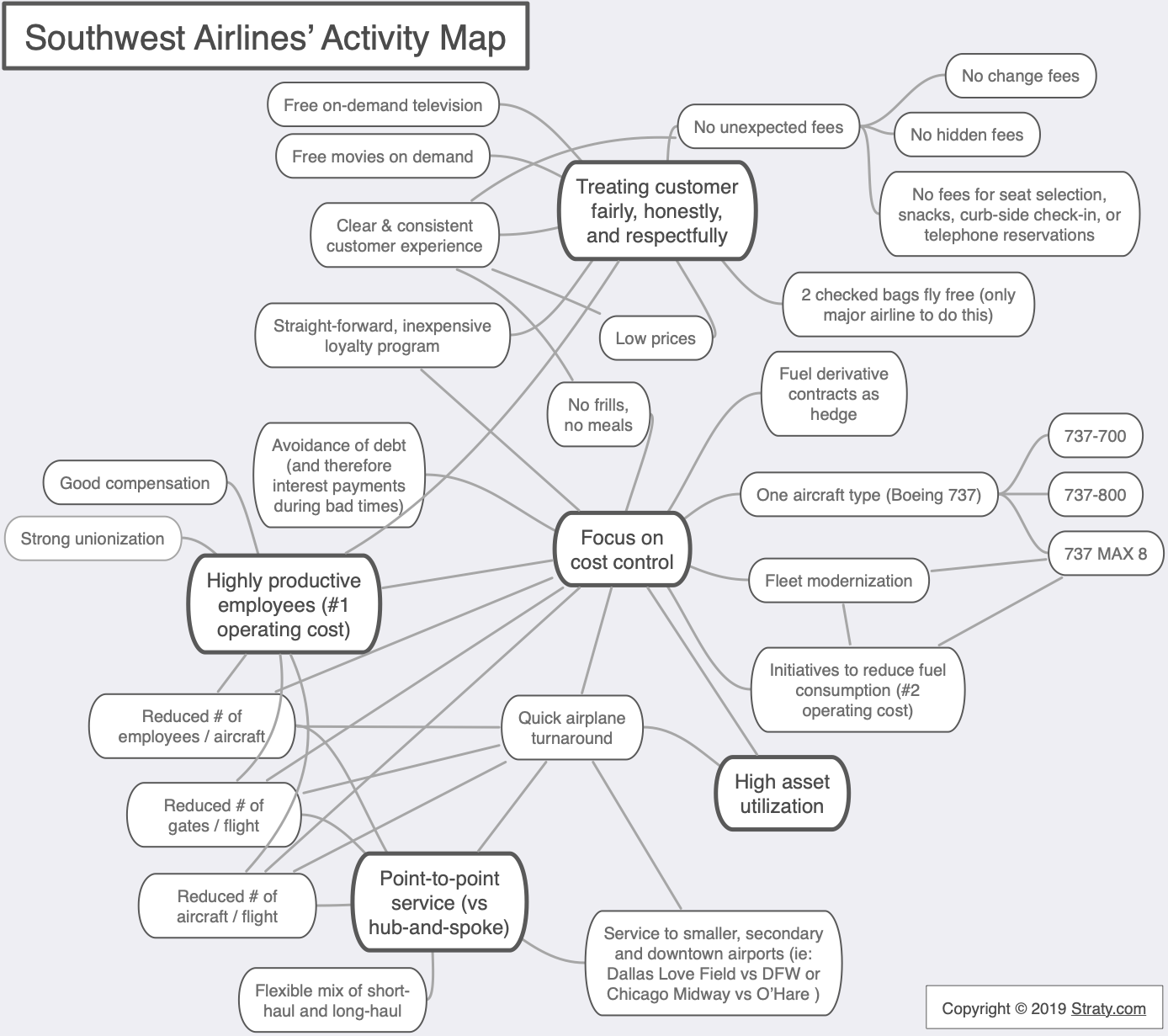

Southwest Airlines’ Activity Map

Now we can dig into their specific activities. This is obviously an incomplete list fo their activities, but it’s a starting place to illustrate the importance of alignment.

As you can see visually, most of their activities reinforce one or several other activities, resulting in very high alignment.

Alignment Isn’t Risk-Free

Southwest’s strategy is not, however, without its risks. For example, Boeing is Southwest’s sole supplier for aircraft and many parts. The March 10 crash of a 737 MAX 8 in Ethiopia (the second crash in 6 months of that model) and the subsequent grounding of the entire MAX 8 fleet worldwide is clear evidence of the risks of overly-tight alignment. Neither crash was a Southwest flight.

(Source: CNN)

Fortunately, Southwest only owned 31 MAX 8s as of Jan 1, 2019 (of a total fleet of 750). But grounding 4% of your fleet is a big deal and Southwest is due to buy or acquire another 37 MAX 8s in 2019 and over 200 MAX 8s over the next 8 years. I’m confident that Southwest will survive the 737 MAX 8 issue relatively unscathed, but the unfortunate events are a clear reminder that even brilliant strategies like Southwest’s are neither permanent nor invincible.

Key Take-Aways

- A good strategy is inherently well-aligned. Good alignment is the best way to deliver disproportionate value and results (1 + 1 = 3). Poor alignment usually means that some parts of a system are destroying value that was created elsewhere.

- Tradeoffs are inevitable, but should be deliberate. For example, Southwest chooses to invest heavily in its employees and in ways to reduce fuel costs. A myopic focus on cutting costs would be a huge mistake long-term.

- While there may be many ways to win, just choose one. Southwest ignores the high-end travel market and focuses on a low cost strategy. The company knows exactly what it is and what it isn’t. And, just as important, they’re disciplined about it. Focus and consistency have the additional benefit of carving out a clear brand in customer’s minds over time.

- Cut activities that don’t fit (49 services Google has killed, some of which they acquired at great cost) and double down on activities that do fit. YouTube, Android, Google Home, Maps, and Chrome may feel like expensive & unprofitable distractions on the surface, but they actually fit very tightly with Google’s/Alphabet’s core strengths: organizing the world’s data, powerful search, and monetizing intent via advertising.

- Remember: you have to be crystal clear on your objective before you even begin to worry about what activities to perform or not.

Herb Kelleher, Southwest’s Heart

This short podcast with Herb Kelleher, the co-founder and former CEO of Southwest, is a must-listen. Herb was a living legend until he passed away early this year. I was deeply saddened by Herb’s passing but I promise you’ll laugh out loud if you check it out.

Also, Southwest Magazine did a nice job with an extended article about Herb’s life. The opening story is classic Herb.

Concept: Hidden Competition

One last thing.. writing this piece made me think about a cool concept: Hidden Competition.

When Southwest first started flying in 1971, they weren’t really competing with the major interstate airlines, whose customers were mostly businessmen with expense accounts. Southwest’s quick flights between Dallas, Houston, and San Antonio were actually competing with Greyhound and other surface travel options. For Greyhound, Southwest represented hidden competition and was a key reason Greyhound is only a fraction of its former self and filed for bankruptcy in 1990.